THIS POST IS OUT OF DATE: AN UPDATE OF THIS POST’S INFORMATION IS AT THIS LINK HERE! (Also I bet that WordPress.com just garbled the code in this post.)

I’m keeping this post up for the sake of preserving a record.

This post is the second in a two-part series on stock data analysis using Python, based on a lecture I gave on the subject for MATH 3900 (Data Mining) at the University of Utah (read part 1 here). In these posts, I will discuss basics such as obtaining the data from Yahoo! Finance using pandas, visualizing stock data, moving averages, developing a moving-average crossover strategy, backtesting, and benchmarking. This second post discusses topics including divising a moving average crossover strategy, backtesting, and benchmarking, along with practice problems for readers to ponder.

NOTE: The information in this post is of a general nature containing information and opinions from the author’s perspective. None of the content of this post should be considered financial advice. Furthermore, any code written here is provided without any form of guarantee. Individuals who choose to use it do so at their own risk.

Trading Strategy

Call an open position a trade that will be terminated in the future when a condition is met. A long position is one in which a profit is made if the financial instrument traded increases in value, and a short position is on in which a profit is made if the financial asset being traded decreases in value. When trading stocks directly, all long positions are bullish and all short position are bearish. That said, a bullish attitude need not be accompanied by a long position, and a bearish attitude need not be accompanied by a short position (this is particularly true when trading stock options).

Here is an example. Let’s say you buy a stock with the expectation that the stock will increase in value, with a plan to sell the stock at a higher price. This is a long position: you are holding a financial asset for which you will profit if the asset increases in value. Your potential profit is unlimited, and your potential losses are limited by the price of the stock since stock prices never go below zero. On the other hand, if you expect a stock to decrease in value, you may borrow the stock from a brokerage firm and sell it, with the expectation of buying the stock back later at a lower price, thus earning you a profit. This is called shorting a stock, and is a short position, since you will earn a profit if the stock drops in value. The potential profit from shorting a stock is limited by the price of the stock (the best you can do is have the stock become worth nothing; you buy it back for free), while the losses are unlimited, since you could potentially spend an arbitrarily large amount of money to buy the stock back. Thus, a broker will expect an investor to be in a very good financial position before allowing the investor to short a stock.

Any trader must have a set of rules that determine how much of her money she is willing to bet on any single trade. For example, a trader may decide that under no circumstances will she risk more than 10% of her portfolio on a trade. Additionally, in any trade, a trader must have an exit strategy, a set of conditions determining when she will exit the position, for either profit or loss. A trader may set a target, which is the minimum profit that will induce the trader to leave the position. Likewise, a trader must have a maximum loss she is willing to tolerate; if potential losses go beyond this amount, the trader will exit the position in order to prevent any further loss (this is usually done by setting a stop-loss order, an order that is triggered to prevent further losses).

We will call a plan that includes trading signals for prompting trades, a rule for deciding how much of the portfolio to risk on any particular strategy, and a complete exit strategy for any trade an overall trading strategy. Our concern now is to design and evaluate trading strategies.

We will suppose that the amount of money in the portfolio involved in any particular trade is a fixed proportion; 10% seems like a good number. We will also say that for any trade, if losses exceed 20% of the value of the trade, we will exit the position. Now we need a means for deciding when to enter position and when to exit for a profit.

Here, I will be demonstrating a moving average crossover strategy. We will use two moving averages, one we consider “fast”, and the other “slow”. The strategy is:

- Trade the asset when the fast moving average crosses over the slow moving average.

- Exit the trade when the fast moving average crosses over the slow moving average again.

A long trade will be prompted when the fast moving average crosses from below to above the slow moving average, and the trade will be exited when the fast moving average crosses below the slow moving average later. A short trade will be prompted when the fast moving average crosses below the slow moving average, and the trade will be exited when the fast moving average later crosses above the slow moving average.

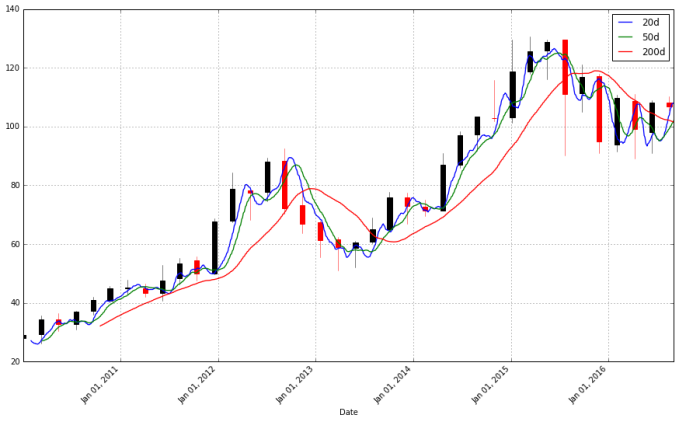

We now have a complete strategy. But before we decide we want to use it, we should try to evaluate the quality of the strategy first. The usual means for doing so is backtesting, which is looking at how profitable the strategy is on historical data. For example, looking at the above chart’s performance on Apple stock, if the 20-day moving average is the fast moving average and the 50-day moving average the slow, this strategy does not appear to be very profitable, at least not if you are always taking long positions.

Let’s see if we can automate the backtesting task. We first identify when the 20-day average is below the 50-day average, and vice versa.

apple['20d-50d'] = apple['20d'] - apple['50d'] apple.tail()

| Open | High | Low | Close | Volume | Adj Close | 20d | 50d | 200d | 20d-50d | |

|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||

| 2016-08-26 | 107.410004 | 107.949997 | 106.309998 | 106.940002 | 27766300 | 106.940002 | 107.87 | 101.51 | 102.73 | 6.36 |

| 2016-08-29 | 106.620003 | 107.440002 | 106.290001 | 106.820000 | 24970300 | 106.820000 | 107.91 | 101.74 | 102.68 | 6.17 |

| 2016-08-30 | 105.800003 | 106.500000 | 105.500000 | 106.000000 | 24863900 | 106.000000 | 107.98 | 101.96 | 102.63 | 6.02 |

| 2016-08-31 | 105.660004 | 106.570000 | 105.639999 | 106.099998 | 29662400 | 106.099998 | 108.00 | 102.16 | 102.60 | 5.84 |

| 2016-09-01 | 106.139999 | 106.800003 | 105.620003 | 106.730003 | 26643600 | 106.730003 | 108.04 | 102.39 | 102.56 | 5.65 |

We will refer to the sign of this difference as the regime; that is, if the fast moving average is above the slow moving average, this is a bullish regime (the bulls rule), and a bearish regime (the bears rule) holds when the fast moving average is below the slow moving average. I identify regimes with the following code.

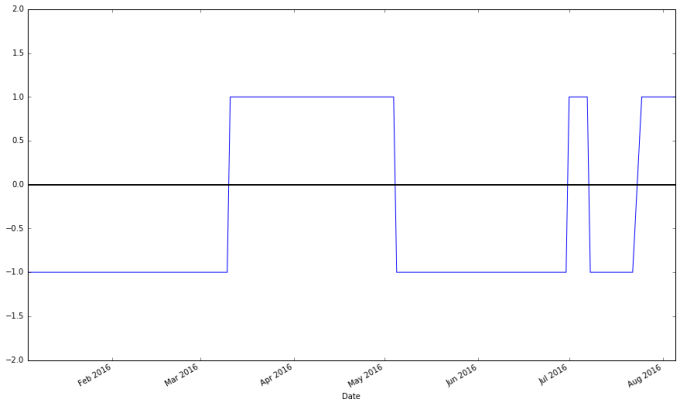

# np.where() is a vectorized if-else function, where a condition is checked for each component of a vector, and the first argument passed is used when the condition holds, and the other passed if it does not apple["Regime"] = np.where(apple['20d-50d'] > 0, 1, 0) # We have 1's for bullish regimes and 0's for everything else. Below I replace bearish regimes's values with -1, and to maintain the rest of the vector, the second argument is apple["Regime"] apple["Regime"] = np.where(apple['20d-50d'] < 0, -1, apple["Regime"]) apple.loc['2016-01-01':'2016-08-07',"Regime"].plot(ylim = (-2,2)).axhline(y = 0, color = "black", lw = 2)

apple["Regime"].plot(ylim = (-2,2)).axhline(y = 0, color = "black", lw = 2)

apple["Regime"].value_counts()

1 966

-1 663

0 50

Name: Regime, dtype: int64

The last line above indicates that for 1005 days the market was bearish on Apple, while for 600 days the market was bullish, and it was neutral for 54 days.

Trading signals appear at regime changes. When a bullish regime begins, a buy signal is triggered, and when it ends, a sell signal is triggered. Likewise, when a bearish regime begins, a sell signal is triggered, and when the regime ends, a buy signal is triggered (this is of interest only if you ever will short the stock, or use some derivative like a stock option to bet against the market).

It’s simple to obtain signals. Let indicate the regime at time

, and

the signal at time

. Then:

, with

indicating “sell”,

indicating “buy”, and

no action. We can obtain signals like so:

# To ensure that all trades close out, I temporarily change the regime of the last row to 0 regime_orig = apple.ix[-1, "Regime"] apple.ix[-1, "Regime"] = 0 apple["Signal"] = np.sign(apple["Regime"] - apple["Regime"].shift(1)) # Restore original regime data apple.ix[-1, "Regime"] = regime_orig apple.tail()

| Open | High | Low | Close | Volume | Adj Close | 20d | 50d | 200d | 20d-50d | Regime | Signal | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||||

| 2016-08-26 | 107.410004 | 107.949997 | 106.309998 | 106.940002 | 27766300 | 106.940002 | 107.87 | 101.51 | 102.73 | 6.36 | 1.0 | 0.0 |

| 2016-08-29 | 106.620003 | 107.440002 | 106.290001 | 106.820000 | 24970300 | 106.820000 | 107.91 | 101.74 | 102.68 | 6.17 | 1.0 | 0.0 |

| 2016-08-30 | 105.800003 | 106.500000 | 105.500000 | 106.000000 | 24863900 | 106.000000 | 107.98 | 101.96 | 102.63 | 6.02 | 1.0 | 0.0 |

| 2016-08-31 | 105.660004 | 106.570000 | 105.639999 | 106.099998 | 29662400 | 106.099998 | 108.00 | 102.16 | 102.60 | 5.84 | 1.0 | 0.0 |

| 2016-09-01 | 106.139999 | 106.800003 | 105.620003 | 106.730003 | 26643600 | 106.730003 | 108.04 | 102.39 | 102.56 | 5.65 | 1.0 | -1.0 |

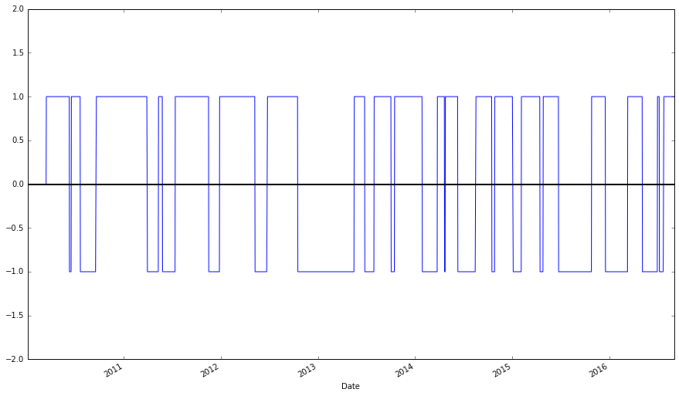

apple["Signal"].plot(ylim = (-2, 2))

apple["Signal"].value_counts()

0.0 1637

-1.0 21

1.0 20

Name: Signal, dtype: int64

We would buy Apple stock 23 times and sell Apple stock 23 times. If we only go long on Apple stock, only 23 trades will be engaged in over the 6-year period, while if we pivot from a long to a short position every time a long position is terminated, we would engage in 23 trades total. (Bear in mind that trading more frequently isn’t necessarily good; trades are never free.)

You may notice that the system as it currently stands isn’t very robust, since even a fleeting moment when the fast moving average is above the slow moving average triggers a trade, resulting in trades that end immediately (which is bad if not simply because realistically every trade is accompanied by a fee that can quickly erode earnings). Additionally, every bullish regime immediately transitions into a bearish regime, and if you were constructing trading systems that allow both bullish and bearish bets, this would lead to the end of one trade immediately triggering a new trade that bets on the market in the opposite direction, which again seems finnicky. A better system would require more evidence that the market is moving in some particular direction. But we will not concern ourselves with these details for now.

Let’s now try to identify what the prices of the stock is at every buy and every sell.

apple.loc[apple["Signal"] == 1, "Close"]

Date

2010-03-16 224.449997

2010-06-18 274.070011

2010-09-20 283.230007

2011-05-12 346.569988

2011-07-14 357.770004

2011-12-28 402.640003

2012-06-25 570.770020

2013-05-17 433.260010

2013-07-31 452.529984

2013-10-16 501.110001

2014-03-26 539.779991

2014-04-25 571.939980

2014-08-18 99.160004

2014-10-28 106.739998

2015-02-05 119.940002

2015-04-28 130.559998

2015-10-27 114.550003

2016-03-11 102.260002

2016-07-01 95.889999

2016-07-25 97.339996

Name: Close, dtype: float64

apple.loc[apple["Signal"] == -1, "Close"]

Date

2010-06-11 253.509995

2010-07-22 259.020000

2011-03-30 348.630009

2011-03-31 348.510006

2011-05-27 337.409992

2011-11-17 377.410000

2012-05-09 569.180023

2012-10-17 644.610001

2013-06-26 398.069992

2013-10-03 483.409996

2014-01-28 506.499977

2014-04-22 531.700020

2014-06-11 93.860001

2014-10-17 97.669998

2015-01-05 106.250000

2015-04-16 126.169998

2015-06-25 127.500000

2015-12-18 106.029999

2016-05-05 93.239998

2016-07-08 96.680000

2016-09-01 106.730003

Name: Close, dtype: float64

# Create a DataFrame with trades, including the price at the trade and the regime under which the trade is made.

apple_signals = pd.concat([

pd.DataFrame({"Price": apple.loc[apple["Signal"] == 1, "Close"],

"Regime": apple.loc[apple["Signal"] == 1, "Regime"],

"Signal": "Buy"}),

pd.DataFrame({"Price": apple.loc[apple["Signal"] == -1, "Close"],

"Regime": apple.loc[apple["Signal"] == -1, "Regime"],

"Signal": "Sell"}),

])

apple_signals.sort_index(inplace = True)

apple_signals

| Price | Regime | Signal | |

|---|---|---|---|

| Date | |||

| 2010-03-16 | 224.449997 | 1.0 | Buy |

| 2010-06-11 | 253.509995 | -1.0 | Sell |

| 2010-06-18 | 274.070011 | 1.0 | Buy |

| 2010-07-22 | 259.020000 | -1.0 | Sell |

| 2010-09-20 | 283.230007 | 1.0 | Buy |

| 2011-03-30 | 348.630009 | 0.0 | Sell |

| 2011-03-31 | 348.510006 | -1.0 | Sell |

| 2011-05-12 | 346.569988 | 1.0 | Buy |

| 2011-05-27 | 337.409992 | -1.0 | Sell |

| 2011-07-14 | 357.770004 | 1.0 | Buy |

| 2011-11-17 | 377.410000 | -1.0 | Sell |

| 2011-12-28 | 402.640003 | 1.0 | Buy |

| 2012-05-09 | 569.180023 | -1.0 | Sell |

| 2012-06-25 | 570.770020 | 1.0 | Buy |

| 2012-10-17 | 644.610001 | -1.0 | Sell |

| 2013-05-17 | 433.260010 | 1.0 | Buy |

| 2013-06-26 | 398.069992 | -1.0 | Sell |

| 2013-07-31 | 452.529984 | 1.0 | Buy |

| 2013-10-03 | 483.409996 | -1.0 | Sell |

| 2013-10-16 | 501.110001 | 1.0 | Buy |

| 2014-01-28 | 506.499977 | -1.0 | Sell |

| 2014-03-26 | 539.779991 | 1.0 | Buy |

| 2014-04-22 | 531.700020 | -1.0 | Sell |

| 2014-04-25 | 571.939980 | 1.0 | Buy |

| 2014-06-11 | 93.860001 | -1.0 | Sell |

| 2014-08-18 | 99.160004 | 1.0 | Buy |

| 2014-10-17 | 97.669998 | -1.0 | Sell |

| 2014-10-28 | 106.739998 | 1.0 | Buy |

| 2015-01-05 | 106.250000 | -1.0 | Sell |

| 2015-02-05 | 119.940002 | 1.0 | Buy |

| 2015-04-16 | 126.169998 | -1.0 | Sell |

| 2015-04-28 | 130.559998 | 1.0 | Buy |

| 2015-06-25 | 127.500000 | -1.0 | Sell |

| 2015-10-27 | 114.550003 | 1.0 | Buy |

| 2015-12-18 | 106.029999 | -1.0 | Sell |

| 2016-03-11 | 102.260002 | 1.0 | Buy |

| 2016-05-05 | 93.239998 | -1.0 | Sell |

| 2016-07-01 | 95.889999 | 1.0 | Buy |

| 2016-07-08 | 96.680000 | -1.0 | Sell |

| 2016-07-25 | 97.339996 | 1.0 | Buy |

| 2016-09-01 | 106.730003 | 1.0 | Sell |

# Let's see the profitability of long trades

apple_long_profits = pd.DataFrame({

"Price": apple_signals.loc[(apple_signals["Signal"] == "Buy") &

apple_signals["Regime"] == 1, "Price"],

"Profit": pd.Series(apple_signals["Price"] - apple_signals["Price"].shift(1)).loc[

apple_signals.loc[(apple_signals["Signal"].shift(1) == "Buy") & (apple_signals["Regime"].shift(1) == 1)].index

].tolist(),

"End Date": apple_signals["Price"].loc[

apple_signals.loc[(apple_signals["Signal"].shift(1) == "Buy") & (apple_signals["Regime"].shift(1) == 1)].index

].index

})

apple_long_profits

| End Date | Price | Profit | |

|---|---|---|---|

| Date | |||

| 2010-03-16 | 2010-06-11 | 224.449997 | 29.059998 |

| 2010-06-18 | 2010-07-22 | 274.070011 | -15.050011 |

| 2010-09-20 | 2011-03-30 | 283.230007 | 65.400002 |

| 2011-05-12 | 2011-05-27 | 346.569988 | -9.159996 |

| 2011-07-14 | 2011-11-17 | 357.770004 | 19.639996 |

| 2011-12-28 | 2012-05-09 | 402.640003 | 166.540020 |

| 2012-06-25 | 2012-10-17 | 570.770020 | 73.839981 |

| 2013-05-17 | 2013-06-26 | 433.260010 | -35.190018 |

| 2013-07-31 | 2013-10-03 | 452.529984 | 30.880012 |

| 2013-10-16 | 2014-01-28 | 501.110001 | 5.389976 |

| 2014-03-26 | 2014-04-22 | 539.779991 | -8.079971 |

| 2014-04-25 | 2014-06-11 | 571.939980 | -478.079979 |

| 2014-08-18 | 2014-10-17 | 99.160004 | -1.490006 |

| 2014-10-28 | 2015-01-05 | 106.739998 | -0.489998 |

| 2015-02-05 | 2015-04-16 | 119.940002 | 6.229996 |

| 2015-04-28 | 2015-06-25 | 130.559998 | -3.059998 |

| 2015-10-27 | 2015-12-18 | 114.550003 | -8.520004 |

| 2016-03-11 | 2016-05-05 | 102.260002 | -9.020004 |

| 2016-07-01 | 2016-07-08 | 95.889999 | 0.790001 |

| 2016-07-25 | 2016-09-01 | 97.339996 | 9.390007 |

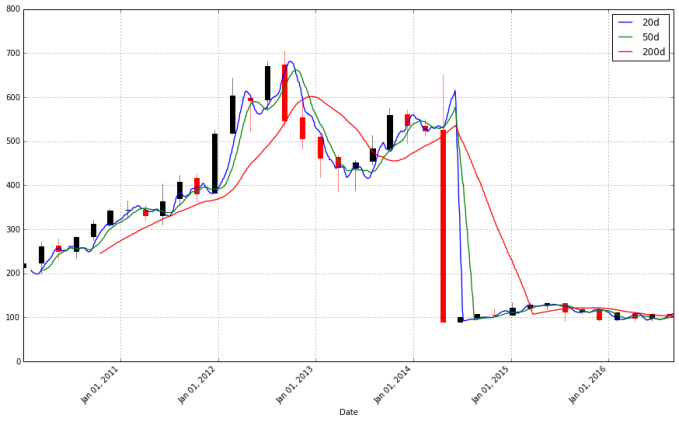

Above, we can see that on May 17th, 2013, there was a massive drop in the price of Apple stock, and it looks like our trading system would do badly. But this price drop is not because of a massive shock to Apple, but simply due to a stock split. And while dividend payments are not as obvious as a stock split, they may be affecting the performance of our system.

# Let's see the result over the whole period for which we have Apple data pandas_candlestick_ohlc(apple, stick = 45, otherseries = ["20d", "50d", "200d"])

We don’t want our trading system to be behaving poorly because of stock splits and dividend payments. How should we handle this? One approach would be to obtain historical stock split and dividend payment data and design a trading system for handling these. This would most realistically represent the behavior of the stock and could be considered the best solution, but it is more complicated. Another solution would be to adjust the prices to account for stock splits and dividend payments.

Yahoo! Finance only provides the adjusted closing price of a stock, but this is all we need to get adjusted opening, high, and low prices. The adjusted close is computed like so:

where is the multiplier used for the adjustment. Solving for

requires only division and thus we can use the closing price and the adjusted closing price to adjust all prices in the series.

Let’s go back, adjust the apple data, and reevaluate our trading system using the adjusted data.

def ohlc_adj(dat):

"""

:param dat: pandas DataFrame with stock data, including "Open", "High", "Low", "Close", and "Adj Close", with "Adj Close" containing adjusted closing prices

:return: pandas DataFrame with adjusted stock data

This function adjusts stock data for splits, dividends, etc., returning a data frame with

"Open", "High", "Low" and "Close" columns. The input DataFrame is similar to that returned

by pandas Yahoo! Finance API.

"""

return pd.DataFrame({"Open": dat["Open"] * dat["Adj Close"] / dat["Close"],

"High": dat["High"] * dat["Adj Close"] / dat["Close"],

"Low": dat["Low"] * dat["Adj Close"] / dat["Close"],

"Close": dat["Adj Close"]})

apple_adj = ohlc_adj(apple)

# This next code repeats all the earlier analysis we did on the adjusted data

apple_adj["20d"] = np.round(apple_adj["Close"].rolling(window = 20, center = False).mean(), 2)

apple_adj["50d"] = np.round(apple_adj["Close"].rolling(window = 50, center = False).mean(), 2)

apple_adj["200d"] = np.round(apple_adj["Close"].rolling(window = 200, center = False).mean(), 2)

apple_adj['20d-50d'] = apple_adj['20d'] - apple_adj['50d']

# np.where() is a vectorized if-else function, where a condition is checked for each component of a vector, and the first argument passed is used when the condition holds, and the other passed if it does not

apple_adj["Regime"] = np.where(apple_adj['20d-50d'] > 0, 1, 0)

# We have 1's for bullish regimes and 0's for everything else. Below I replace bearish regimes's values with -1, and to maintain the rest of the vector, the second argument is apple["Regime"]

apple_adj["Regime"] = np.where(apple_adj['20d-50d'] < 0, -1, apple_adj["Regime"])

# To ensure that all trades close out, I temporarily change the regime of the last row to 0

regime_orig = apple_adj.ix[-1, "Regime"]

apple_adj.ix[-1, "Regime"] = 0

apple_adj["Signal"] = np.sign(apple_adj["Regime"] - apple_adj["Regime"].shift(1))

# Restore original regime data

apple_adj.ix[-1, "Regime"] = regime_orig

# Create a DataFrame with trades, including the price at the trade and the regime under which the trade is made.

apple_adj_signals = pd.concat([

pd.DataFrame({"Price": apple_adj.loc[apple_adj["Signal"] == 1, "Close"],

"Regime": apple_adj.loc[apple_adj["Signal"] == 1, "Regime"],

"Signal": "Buy"}),

pd.DataFrame({"Price": apple_adj.loc[apple_adj["Signal"] == -1, "Close"],

"Regime": apple_adj.loc[apple_adj["Signal"] == -1, "Regime"],

"Signal": "Sell"}),

])

apple_adj_signals.sort_index(inplace = True)

apple_adj_long_profits = pd.DataFrame({

"Price": apple_adj_signals.loc[(apple_adj_signals["Signal"] == "Buy") &

apple_adj_signals["Regime"] == 1, "Price"],

"Profit": pd.Series(apple_adj_signals["Price"] - apple_adj_signals["Price"].shift(1)).loc[

apple_adj_signals.loc[(apple_adj_signals["Signal"].shift(1) == "Buy") & (apple_adj_signals["Regime"].shift(1) == 1)].index

].tolist(),

"End Date": apple_adj_signals["Price"].loc[

apple_adj_signals.loc[(apple_adj_signals["Signal"].shift(1) == "Buy") & (apple_adj_signals["Regime"].shift(1) == 1)].index

].index

})

pandas_candlestick_ohlc(apple_adj, stick = 45, otherseries = ["20d", "50d", "200d"])

apple_adj_long_profits

| End Date | Price | Profit | |

|---|---|---|---|

| Date | |||

| 2010-03-16 | 2010-06-10 | 29.355667 | 3.408371 |

| 2010-06-18 | 2010-07-22 | 35.845436 | -1.968381 |

| 2010-09-20 | 2011-03-30 | 37.043466 | 8.553623 |

| 2011-05-12 | 2011-05-27 | 45.327660 | -1.198030 |

| 2011-07-14 | 2011-11-17 | 46.792503 | 2.568702 |

| 2011-12-28 | 2012-05-09 | 52.661020 | 21.781659 |

| 2012-06-25 | 2012-10-17 | 74.650634 | 10.019459 |

| 2013-05-17 | 2013-06-26 | 57.882798 | -4.701326 |

| 2013-07-31 | 2013-10-04 | 60.457234 | 4.500835 |

| 2013-10-16 | 2014-01-28 | 67.389473 | 1.122523 |

| 2014-03-11 | 2014-03-17 | 72.948554 | -1.272298 |

| 2014-03-24 | 2014-04-22 | 73.370393 | -1.019203 |

| 2014-04-25 | 2014-10-17 | 77.826851 | 16.191371 |

| 2014-10-28 | 2015-01-05 | 102.749105 | -0.028185 |

| 2015-02-05 | 2015-04-16 | 116.413846 | 6.046838 |

| 2015-04-28 | 2015-06-26 | 126.721620 | -3.184117 |

| 2015-10-27 | 2015-12-18 | 112.152083 | -7.897288 |

| 2016-03-10 | 2016-05-05 | 100.015950 | -7.278331 |

| 2016-06-23 | 2016-06-27 | 95.582210 | -4.038123 |

| 2016-06-30 | 2016-07-11 | 95.084904 | 1.372569 |

| 2016-07-25 | 2016-09-01 | 96.815526 | 9.914477 |

As you can see, adjusting for dividends and stock splits makes a big difference. We will use this data from now on.

Let’s now create a simulated portfolio of $1,000,000, and see how it would behave, according to the rules we have established. This includes:

- Investing only 10% of the portfolio in any trade

- Exiting the position if losses exceed 20% of the value of the trade.

When simulating, bear in mind that:

- Trades are done in batches of 100 stocks.

- Our stop-loss rule involves placing an order to sell the stock the moment the price drops below the specified level. Thus we need to check whether the lows during this period ever go low enough to trigger the stop-loss. Realistically, unless we buy a put option, we cannot guarantee that we will sell the stock at the price we set at the stop-loss, but we will use this as the selling price anyway for the sake of simplicity.

- Every trade is accompanied by a commission to the broker, which should be accounted for. I do not do so here.

Here’s how a backtest may look:

# We need to get the low of the price during each trade.

tradeperiods = pd.DataFrame({"Start": apple_adj_long_profits.index,

"End": apple_adj_long_profits["End Date"]})

apple_adj_long_profits["Low"] = tradeperiods.apply(lambda x: min(apple_adj.loc[x["Start"]:x["End"], "Low"]), axis = 1)

apple_adj_long_profits

| End Date | Price | Profit | Low | |

|---|---|---|---|---|

| Date | ||||

| 2010-03-16 | 2010-06-10 | 29.355667 | 3.408371 | 26.059775 |

| 2010-06-18 | 2010-07-22 | 35.845436 | -1.968381 | 31.337127 |

| 2010-09-20 | 2011-03-30 | 37.043466 | 8.553623 | 35.967068 |

| 2011-05-12 | 2011-05-27 | 45.327660 | -1.198030 | 43.084626 |

| 2011-07-14 | 2011-11-17 | 46.792503 | 2.568702 | 46.171251 |

| 2011-12-28 | 2012-05-09 | 52.661020 | 21.781659 | 52.382438 |

| 2012-06-25 | 2012-10-17 | 74.650634 | 10.019459 | 73.975759 |

| 2013-05-17 | 2013-06-26 | 57.882798 | -4.701326 | 52.859502 |

| 2013-07-31 | 2013-10-04 | 60.457234 | 4.500835 | 60.043080 |

| 2013-10-16 | 2014-01-28 | 67.389473 | 1.122523 | 67.136651 |

| 2014-03-11 | 2014-03-17 | 72.948554 | -1.272298 | 71.167335 |

| 2014-03-24 | 2014-04-22 | 73.370393 | -1.019203 | 69.579335 |

| 2014-04-25 | 2014-10-17 | 77.826851 | 16.191371 | 76.740971 |

| 2014-10-28 | 2015-01-05 | 102.749105 | -0.028185 | 101.411076 |

| 2015-02-05 | 2015-04-16 | 116.413846 | 6.046838 | 114.948237 |

| 2015-04-28 | 2015-06-26 | 126.721620 | -3.184117 | 119.733299 |

| 2015-10-27 | 2015-12-18 | 112.152083 | -7.897288 | 104.038477 |

| 2016-03-10 | 2016-05-05 | 100.015950 | -7.278331 | 91.345994 |

| 2016-06-23 | 2016-06-27 | 95.582210 | -4.038123 | 91.006996 |

| 2016-06-30 | 2016-07-11 | 95.084904 | 1.372569 | 93.791913 |

| 2016-07-25 | 2016-09-01 | 96.815526 | 9.914477 | 95.900485 |

# Now we have all the information needed to simulate this strategy in apple_adj_long_profits

cash = 1000000

apple_backtest = pd.DataFrame({"Start Port. Value": [],

"End Port. Value": [],

"End Date": [],

"Shares": [],

"Share Price": [],

"Trade Value": [],

"Profit per Share": [],

"Total Profit": [],

"Stop-Loss Triggered": []})

port_value = .1 # Max proportion of portfolio bet on any trade

batch = 100 # Number of shares bought per batch

stoploss = .2 # % of trade loss that would trigger a stoploss

for index, row in apple_adj_long_profits.iterrows():

batches = np.floor(cash * port_value) // np.ceil(batch * row["Price"]) # Maximum number of batches of stocks invested in

trade_val = batches * batch * row["Price"] # How much money is put on the line with each trade

if row["Low"] < (1 - stoploss) * row["Price"]: # Account for the stop-loss

share_profit = np.round((1 - stoploss) * row["Price"], 2)

stop_trig = True

else:

share_profit = row["Profit"]

stop_trig = False

profit = share_profit * batches * batch # Compute profits

# Add a row to the backtest data frame containing the results of the trade

apple_backtest = apple_backtest.append(pd.DataFrame({

"Start Port. Value": cash,

"End Port. Value": cash + profit,

"End Date": row["End Date"],

"Shares": batch * batches,

"Share Price": row["Price"],

"Trade Value": trade_val,

"Profit per Share": share_profit,

"Total Profit": profit,

"Stop-Loss Triggered": stop_trig

}, index = [index]))

cash = max(0, cash + profit)

apple_backtest

| End Date | End Port. Value | Profit per Share | Share Price | Shares | Start Port. Value | Stop-Loss Triggered | Total Profit | Trade Value | |

|---|---|---|---|---|---|---|---|---|---|

| 2010-03-16 | 2010-06-10 | 1.011588e+06 | 3.408371 | 29.355667 | 3400.0 | 1.000000e+06 | 0.0 | 11588.4614 | 99809.2678 |

| 2010-06-18 | 2010-07-22 | 1.006077e+06 | -1.968381 | 35.845436 | 2800.0 | 1.011588e+06 | 0.0 | -5511.4668 | 100367.2208 |

| 2010-09-20 | 2011-03-30 | 1.029172e+06 | 8.553623 | 37.043466 | 2700.0 | 1.006077e+06 | 0.0 | 23094.7821 | 100017.3582 |

| 2011-05-12 | 2011-05-27 | 1.026536e+06 | -1.198030 | 45.327660 | 2200.0 | 1.029172e+06 | 0.0 | -2635.6660 | 99720.8520 |

| 2011-07-14 | 2011-11-17 | 1.031930e+06 | 2.568702 | 46.792503 | 2100.0 | 1.026536e+06 | 0.0 | 5394.2742 | 98264.2563 |

| 2011-12-28 | 2012-05-09 | 1.073316e+06 | 21.781659 | 52.661020 | 1900.0 | 1.031930e+06 | 0.0 | 41385.1521 | 100055.9380 |

| 2012-06-25 | 2012-10-17 | 1.087343e+06 | 10.019459 | 74.650634 | 1400.0 | 1.073316e+06 | 0.0 | 14027.2426 | 104510.8876 |

| 2013-05-17 | 2013-06-26 | 1.078880e+06 | -4.701326 | 57.882798 | 1800.0 | 1.087343e+06 | 0.0 | -8462.3868 | 104189.0364 |

| 2013-07-31 | 2013-10-04 | 1.086532e+06 | 4.500835 | 60.457234 | 1700.0 | 1.078880e+06 | 0.0 | 7651.4195 | 102777.2978 |

| 2013-10-16 | 2014-01-28 | 1.088328e+06 | 1.122523 | 67.389473 | 1600.0 | 1.086532e+06 | 0.0 | 1796.0368 | 107823.1568 |

| 2014-03-11 | 2014-03-17 | 1.086547e+06 | -1.272298 | 72.948554 | 1400.0 | 1.088328e+06 | 0.0 | -1781.2172 | 102127.9756 |

| 2014-03-24 | 2014-04-22 | 1.085120e+06 | -1.019203 | 73.370393 | 1400.0 | 1.086547e+06 | 0.0 | -1426.8842 | 102718.5502 |

| 2014-04-25 | 2014-10-17 | 1.106169e+06 | 16.191371 | 77.826851 | 1300.0 | 1.085120e+06 | 0.0 | 21048.7823 | 101174.9063 |

| 2014-10-28 | 2015-01-05 | 1.106140e+06 | -0.028185 | 102.749105 | 1000.0 | 1.106169e+06 | 0.0 | -28.1850 | 102749.1050 |

| 2015-02-05 | 2015-04-16 | 1.111582e+06 | 6.046838 | 116.413846 | 900.0 | 1.106140e+06 | 0.0 | 5442.1542 | 104772.4614 |

| 2015-04-28 | 2015-06-26 | 1.109035e+06 | -3.184117 | 126.721620 | 800.0 | 1.111582e+06 | 0.0 | -2547.2936 | 101377.2960 |

| 2015-10-27 | 2015-12-18 | 1.101928e+06 | -7.897288 | 112.152083 | 900.0 | 1.109035e+06 | 0.0 | -7107.5592 | 100936.8747 |

| 2016-03-10 | 2016-05-05 | 1.093921e+06 | -7.278331 | 100.015950 | 1100.0 | 1.101928e+06 | 0.0 | -8006.1641 | 110017.5450 |

| 2016-06-23 | 2016-06-27 | 1.089480e+06 | -4.038123 | 95.582210 | 1100.0 | 1.093921e+06 | 0.0 | -4441.9353 | 105140.4310 |

| 2016-06-30 | 2016-07-11 | 1.090989e+06 | 1.372569 | 95.084904 | 1100.0 | 1.089480e+06 | 0.0 | 1509.8259 | 104593.3944 |

| 2016-07-25 | 2016-09-01 | 1.101895e+06 | 9.914477 | 96.815526 | 1100.0 | 1.090989e+06 | 0.0 | 10905.9247 | 106497.0786 |

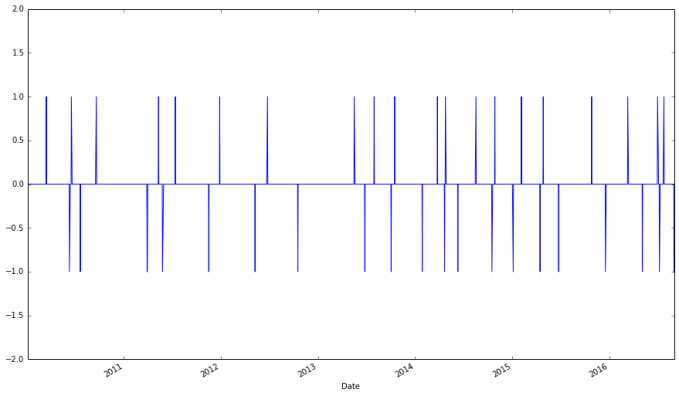

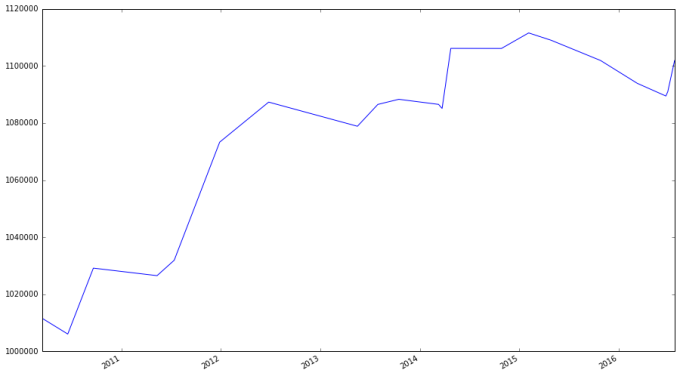

apple_backtest["End Port. Value"].plot()

Our portfolio’s value grew by 10% in about six years. Considering that only 10% of the portfolio was ever involved in any single trade, this is not bad performance.

Notice that this strategy never lead to our stop-loss order being triggered. Does this mean we don’t need stop-loss orders? There is no simple answer to this. After all, if we had chosen a different level at which a stop-loss would be triggered, we may have seen it triggered.

Stop-loss orders are automatically triggered and ask no question as to why the order was triggered. This means that both a genuine change in trend or a momentary fluctuation can trigger a stop-loss, with the latter being the more concerning reason since not only do you have to pay for the order, there is no guarantee that you will sell the stock at the price you set, which could make your losses worse. Meanwhile, the trend on which you based your trade still holds, and had the stop-loss not been triggered, you may have made a profit. That said, a stop-loss can help you protect against your own emotions, staying wedded to a trade even though it has lost its value. They’re also good to have if you cannot monitor or quickly access your portfolio, like when you are on vacation.

I have provided links both for and “against” the use of stop-loss orders, but from now on I’m not going to require our backtesting system to account for them. While less realistic (and I do believe an industrial-strength system should account for a stop-loss rule), this simplifies the backtesting task.

A more realistic portfolio would not be betting 10% of its value on only one stock. A more realistic one would consider investing in multiple stocks. Multiple trades may be ongoing at any given time involving multiple companies, and most of the portfolio will be in stocks, not cash. Now that we will be investing in multiple stops and exiting only when moving averages cross (not because of a stop-loss), we will need to change our approach to backtesting. For example, we will be using one pandas DataFrame to contain all buy and sell orders for all stocks being considered, and our loop above will have to track more information.

I have written functions for creating order data for multiple stocks, and a function for performing the backtesting.

def ma_crossover_orders(stocks, fast, slow):

"""

:param stocks: A list of tuples, the first argument in each tuple being a string containing the ticker symbol of each stock (or however you want the stock represented, so long as it's unique), and the second being a pandas DataFrame containing the stocks, with a "Close" column and indexing by date (like the data frames returned by the Yahoo! Finance API)

:param fast: Integer for the number of days used in the fast moving average

:param slow: Integer for the number of days used in the slow moving average

:return: pandas DataFrame containing stock orders

This function takes a list of stocks and determines when each stock would be bought or sold depending on a moving average crossover strategy, returning a data frame with information about when the stocks in the portfolio are bought or sold according to the strategy

"""

fast_str = str(fast) + 'd'

slow_str = str(slow) + 'd'

ma_diff_str = fast_str + '-' + slow_str

trades = pd.DataFrame({"Price": [], "Regime": [], "Signal": []})

for s in stocks:

# Get the moving averages, both fast and slow, along with the difference in the moving averages

s[1][fast_str] = np.round(s[1]["Close"].rolling(window = fast, center = False).mean(), 2)

s[1][slow_str] = np.round(s[1]["Close"].rolling(window = slow, center = False).mean(), 2)

s[1][ma_diff_str] = s[1][fast_str] - s[1][slow_str]

# np.where() is a vectorized if-else function, where a condition is checked for each component of a vector, and the first argument passed is used when the condition holds, and the other passed if it does not

s[1]["Regime"] = np.where(s[1][ma_diff_str] > 0, 1, 0)

# We have 1's for bullish regimes and 0's for everything else. Below I replace bearish regimes's values with -1, and to maintain the rest of the vector, the second argument is apple["Regime"]

s[1]["Regime"] = np.where(s[1][ma_diff_str] < 0, -1, s[1]["Regime"])

# To ensure that all trades close out, I temporarily change the regime of the last row to 0

regime_orig = s[1].ix[-1, "Regime"]

s[1].ix[-1, "Regime"] = 0

s[1]["Signal"] = np.sign(s[1]["Regime"] - s[1]["Regime"].shift(1))

# Restore original regime data

s[1].ix[-1, "Regime"] = regime_orig

# Get signals

signals = pd.concat([

pd.DataFrame({"Price": s[1].loc[s[1]["Signal"] == 1, "Close"],

"Regime": s[1].loc[s[1]["Signal"] == 1, "Regime"],

"Signal": "Buy"}),

pd.DataFrame({"Price": s[1].loc[s[1]["Signal"] == -1, "Close"],

"Regime": s[1].loc[s[1]["Signal"] == -1, "Regime"],

"Signal": "Sell"}),

])

signals.index = pd.MultiIndex.from_product([signals.index, [s[0]]], names = ["Date", "Symbol"])

trades = trades.append(signals)

trades.sort_index(inplace = True)

trades.index = pd.MultiIndex.from_tuples(trades.index, names = ["Date", "Symbol"])

return trades

def backtest(signals, cash, port_value = .1, batch = 100):

"""

:param signals: pandas DataFrame containing buy and sell signals with stock prices and symbols, like that returned by ma_crossover_orders

:param cash: integer for starting cash value

:param port_value: maximum proportion of portfolio to risk on any single trade

:param batch: Trading batch sizes

:return: pandas DataFrame with backtesting results

This function backtests strategies, with the signals generated by the strategies being passed in the signals DataFrame. A fictitious portfolio is simulated and the returns generated by this portfolio are reported.

"""

SYMBOL = 1 # Constant for which element in index represents symbol

portfolio = dict() # Will contain how many stocks are in the portfolio for a given symbol

port_prices = dict() # Tracks old trade prices for determining profits

# Dataframe that will contain backtesting report

results = pd.DataFrame({"Start Cash": [],

"End Cash": [],

"Portfolio Value": [],

"Type": [],

"Shares": [],

"Share Price": [],

"Trade Value": [],

"Profit per Share": [],

"Total Profit": []})

for index, row in signals.iterrows():

# These first few lines are done for any trade

shares = portfolio.setdefault(index[SYMBOL], 0)

trade_val = 0

batches = 0

cash_change = row["Price"] * shares # Shares could potentially be a positive or negative number (cash_change will be added in the end; negative shares indicate a short)

portfolio[index[SYMBOL]] = 0 # For a given symbol, a position is effectively cleared

old_price = port_prices.setdefault(index[SYMBOL], row["Price"])

portfolio_val = 0

for key, val in portfolio.items():

portfolio_val += val * port_prices[key]

if row["Signal"] == "Buy" and row["Regime"] == 1: # Entering a long position

batches = np.floor((portfolio_val + cash) * port_value) // np.ceil(batch * row["Price"]) # Maximum number of batches of stocks invested in

trade_val = batches * batch * row["Price"] # How much money is put on the line with each trade

cash_change -= trade_val # We are buying shares so cash will go down

portfolio[index[SYMBOL]] = batches * batch # Recording how many shares are currently invested in the stock

port_prices[index[SYMBOL]] = row["Price"] # Record price

old_price = row["Price"]

elif row["Signal"] == "Sell" and row["Regime"] == -1: # Entering a short

pass

# Do nothing; can we provide a method for shorting the market?

#else:

#raise ValueError("I don't know what to do with signal " + row["Signal"])

pprofit = row["Price"] - old_price # Compute profit per share; old_price is set in such a way that entering a position results in a profit of zero

# Update report

results = results.append(pd.DataFrame({

"Start Cash": cash,

"End Cash": cash + cash_change,

"Portfolio Value": cash + cash_change + portfolio_val + trade_val,

"Type": row["Signal"],

"Shares": batch * batches,

"Share Price": row["Price"],

"Trade Value": abs(cash_change),

"Profit per Share": pprofit,

"Total Profit": batches * batch * pprofit

}, index = [index]))

cash += cash_change # Final change to cash balance

results.sort_index(inplace = True)

results.index = pd.MultiIndex.from_tuples(results.index, names = ["Date", "Symbol"])

return results

# Get more stocks

microsoft = web.DataReader("MSFT", "yahoo", start, end)

google = web.DataReader("GOOG", "yahoo", start, end)

facebook = web.DataReader("FB", "yahoo", start, end)

twitter = web.DataReader("TWTR", "yahoo", start, end)

netflix = web.DataReader("NFLX", "yahoo", start, end)

amazon = web.DataReader("AMZN", "yahoo", start, end)

yahoo = web.DataReader("YHOO", "yahoo", start, end)

sony = web.DataReader("SNY", "yahoo", start, end)

nintendo = web.DataReader("NTDOY", "yahoo", start, end)

ibm = web.DataReader("IBM", "yahoo", start, end)

hp = web.DataReader("HPQ", "yahoo", start, end)

signals = ma_crossover_orders([("AAPL", ohlc_adj(apple)),

("MSFT", ohlc_adj(microsoft)),

("GOOG", ohlc_adj(google)),

("FB", ohlc_adj(facebook)),

("TWTR", ohlc_adj(twitter)),

("NFLX", ohlc_adj(netflix)),

("AMZN", ohlc_adj(amazon)),

("YHOO", ohlc_adj(yahoo)),

("SNY", ohlc_adj(yahoo)),

("NTDOY", ohlc_adj(nintendo)),

("IBM", ohlc_adj(ibm)),

("HPQ", ohlc_adj(hp))],

fast = 20, slow = 50)

signals

| Price | Regime | Signal | ||

|---|---|---|---|---|

| Date | Symbol | |||

| 2010-03-16 | AAPL | 29.355667 | 1.0 | Buy |

| AMZN | 131.789993 | 1.0 | Buy | |

| GOOG | 282.318173 | -1.0 | Sell | |

| HPQ | 20.722316 | 1.0 | Buy | |

| IBM | 110.563240 | 1.0 | Buy | |

| MSFT | 24.677580 | -1.0 | Sell | |

| NFLX | 10.090000 | 1.0 | Buy | |

| NTDOY | 37.099998 | 1.0 | Buy | |

| SNY | 16.360001 | -1.0 | Sell | |

| YHOO | 16.360001 | -1.0 | Sell | |

| 2010-03-17 | SNY | 16.500000 | 1.0 | Buy |

| YHOO | 16.500000 | 1.0 | Buy | |

| 2010-03-22 | GOOG | 278.472004 | 1.0 | Buy |

| 2010-03-23 | MSFT | 25.106096 | 1.0 | Buy |

| 2010-05-03 | GOOG | 265.035411 | -1.0 | Sell |

| 2010-05-10 | HPQ | 19.435830 | -1.0 | Sell |

| 2010-05-14 | NTDOY | 35.799999 | -1.0 | Sell |

| 2010-05-17 | SNY | 16.270000 | -1.0 | Sell |

| YHOO | 16.270000 | -1.0 | Sell | |

| 2010-05-19 | AMZN | 124.589996 | -1.0 | Sell |

| MSFT | 23.835187 | -1.0 | Sell | |

| 2010-05-21 | IBM | 108.322991 | -1.0 | Sell |

| 2010-06-10 | AAPL | 32.764038 | 0.0 | Sell |

| 2010-06-11 | AAPL | 33.156405 | -1.0 | Sell |

| 2010-06-18 | AAPL | 35.845436 | 1.0 | Buy |

| 2010-06-28 | IBM | 111.397697 | 1.0 | Buy |

| 2010-07-01 | IBM | 105.861499 | -1.0 | Sell |

| 2010-07-06 | IBM | 106.630175 | 1.0 | Buy |

| 2010-07-09 | NTDOY | 36.950001 | 1.0 | Buy |

| 2010-07-20 | IBM | 109.298956 | -1.0 | Sell |

| … | … | … | … | … |

| 2016-06-23 | AAPL | 95.582210 | 1.0 | Buy |

| TWTR | 17.040001 | 1.0 | Buy | |

| 2016-06-27 | AAPL | 91.544087 | -1.0 | Sell |

| FB | 108.970001 | -1.0 | Sell | |

| 2016-06-28 | SNY | 36.040001 | -1.0 | Sell |

| YHOO | 36.040001 | -1.0 | Sell | |

| 2016-06-30 | AAPL | 95.084904 | 1.0 | Buy |

| NFLX | 91.480003 | 0.0 | Sell | |

| 2016-07-01 | NFLX | 96.669998 | -1.0 | Sell |

| SNY | 37.990002 | 1.0 | Buy | |

| YHOO | 37.990002 | 1.0 | Buy | |

| 2016-07-11 | AAPL | 96.457473 | -1.0 | Sell |

| NTDOY | 27.700001 | 1.0 | Buy | |

| 2016-07-14 | MSFT | 53.407133 | 1.0 | Buy |

| 2016-07-25 | AAPL | 96.815526 | 1.0 | Buy |

| FB | 121.629997 | 1.0 | Buy | |

| 2016-07-26 | GOOG | 738.419983 | 1.0 | Buy |

| 2016-08-18 | NFLX | 96.160004 | 1.0 | Buy |

| 2016-09-01 | AAPL | 106.730003 | 1.0 | Sell |

| 2016-09-02 | AMZN | 772.440002 | 1.0 | Sell |

| FB | 126.510002 | 1.0 | Sell | |

| GOOG | 771.460022 | 1.0 | Sell | |

| HPQ | 14.490000 | 1.0 | Sell | |

| IBM | 159.550003 | 1.0 | Sell | |

| MSFT | 57.669998 | 1.0 | Sell | |

| NFLX | 97.379997 | 1.0 | Sell | |

| NTDOY | 28.840000 | 1.0 | Sell | |

| SNY | 43.279999 | 1.0 | Sell | |

| TWTR | 19.549999 | 1.0 | Sell | |

| YHOO | 43.279999 | 1.0 | Sell |

475 rows × 3 columns

bk = backtest(signals, 1000000) bk

| End Cash | Portfolio Value | Profit per Share | Share Price | Shares | Start Cash | Total Profit | Trade Value | Type | ||

|---|---|---|---|---|---|---|---|---|---|---|

| Date | Symbol | |||||||||

| 2010-03-16 | AAPL | 9.001907e+05 | 1.000000e+06 | 0.000000 | 29.355667 | 3400.0 | 1.000000e+06 | 0.0 | 99809.2678 | Buy |

| AMZN | 8.079377e+05 | 1.000000e+06 | 0.000000 | 131.789993 | 700.0 | 9.001907e+05 | 0.0 | 92252.9951 | Buy | |

| GOOG | 8.079377e+05 | 1.000000e+06 | 0.000000 | 282.318173 | 0.0 | 8.079377e+05 | 0.0 | 0.0000 | Sell | |

| HPQ | 7.084706e+05 | 1.000000e+06 | 0.000000 | 20.722316 | 4800.0 | 8.079377e+05 | 0.0 | 99467.1168 | Buy | |

| IBM | 6.089637e+05 | 1.000000e+06 | 0.000000 | 110.563240 | 900.0 | 7.084706e+05 | 0.0 | 99506.9160 | Buy | |

| MSFT | 6.089637e+05 | 1.000000e+06 | 0.000000 | 24.677580 | 0.0 | 6.089637e+05 | 0.0 | 0.0000 | Sell | |

| NFLX | 5.090727e+05 | 1.000000e+06 | 0.000000 | 10.090000 | 9900.0 | 6.089637e+05 | 0.0 | 99891.0000 | Buy | |

| NTDOY | 4.126127e+05 | 1.000000e+06 | 0.000000 | 37.099998 | 2600.0 | 5.090727e+05 | 0.0 | 96459.9948 | Buy | |

| SNY | 4.126127e+05 | 1.000000e+06 | 0.000000 | 16.360001 | 0.0 | 4.126127e+05 | 0.0 | 0.0000 | Sell | |

| YHOO | 4.126127e+05 | 1.000000e+06 | 0.000000 | 16.360001 | 0.0 | 4.126127e+05 | 0.0 | 0.0000 | Sell | |

| 2010-03-17 | SNY | 3.136127e+05 | 1.000000e+06 | 0.000000 | 16.500000 | 6000.0 | 4.126127e+05 | 0.0 | 99000.0000 | Buy |

| YHOO | 2.146127e+05 | 1.000000e+06 | 0.000000 | 16.500000 | 6000.0 | 3.136127e+05 | 0.0 | 99000.0000 | Buy | |

| 2010-03-22 | GOOG | 1.310711e+05 | 1.000000e+06 | 0.000000 | 278.472004 | 300.0 | 2.146127e+05 | 0.0 | 83541.6012 | Buy |

| 2010-03-23 | MSFT | 3.315733e+04 | 1.000000e+06 | 0.000000 | 25.106096 | 3900.0 | 1.310711e+05 | 0.0 | 97913.7744 | Buy |

| 2010-05-03 | GOOG | 1.126680e+05 | 9.959690e+05 | -13.436593 | 265.035411 | 0.0 | 3.315733e+04 | -0.0 | 79510.6233 | Sell |

| 2010-05-10 | HPQ | 2.059599e+05 | 9.897939e+05 | -1.286486 | 19.435830 | 0.0 | 1.126680e+05 | -0.0 | 93291.9840 | Sell |

| 2010-05-14 | NTDOY | 2.990399e+05 | 9.864139e+05 | -1.299999 | 35.799999 | 0.0 | 2.059599e+05 | -0.0 | 93079.9974 | Sell |

| 2010-05-17 | SNY | 3.966599e+05 | 9.850339e+05 | -0.230000 | 16.270000 | 0.0 | 2.990399e+05 | -0.0 | 97620.0000 | Sell |

| YHOO | 4.942799e+05 | 9.836539e+05 | -0.230000 | 16.270000 | 0.0 | 3.966599e+05 | -0.0 | 97620.0000 | Sell | |

| 2010-05-19 | AMZN | 5.814929e+05 | 9.786139e+05 | -7.199997 | 124.589996 | 0.0 | 4.942799e+05 | -0.0 | 87212.9972 | Sell |

| MSFT | 6.744502e+05 | 9.736573e+05 | -1.270909 | 23.835187 | 0.0 | 5.814929e+05 | -0.0 | 92957.2293 | Sell | |

| 2010-05-21 | IBM | 7.719409e+05 | 9.716411e+05 | -2.240249 | 108.322991 | 0.0 | 6.744502e+05 | -0.0 | 97490.6919 | Sell |

| 2010-06-10 | AAPL | 8.833386e+05 | 9.832296e+05 | 3.408371 | 32.764038 | 0.0 | 7.719409e+05 | 0.0 | 111397.7292 | Sell |

| 2010-06-11 | AAPL | 8.833386e+05 | 9.832296e+05 | 3.800738 | 33.156405 | 0.0 | 8.833386e+05 | 0.0 | 0.0000 | Sell |

| 2010-06-18 | AAPL | 7.865559e+05 | 9.832296e+05 | 0.000000 | 35.845436 | 2700.0 | 8.833386e+05 | 0.0 | 96782.6772 | Buy |

| 2010-06-28 | IBM | 6.974378e+05 | 9.832296e+05 | 0.000000 | 111.397697 | 800.0 | 7.865559e+05 | 0.0 | 89118.1576 | Buy |

| 2010-07-01 | IBM | 7.821270e+05 | 9.788006e+05 | -5.536198 | 105.861499 | 0.0 | 6.974378e+05 | -0.0 | 84689.1992 | Sell |

| 2010-07-06 | IBM | 6.861598e+05 | 9.788006e+05 | 0.000000 | 106.630175 | 900.0 | 7.821270e+05 | 0.0 | 95967.1575 | Buy |

| 2010-07-09 | NTDOY | 5.900898e+05 | 9.788006e+05 | 0.000000 | 36.950001 | 2600.0 | 6.861598e+05 | 0.0 | 96070.0026 | Buy |

| 2010-07-20 | IBM | 6.884589e+05 | 9.812025e+05 | 2.668781 | 109.298956 | 0.0 | 5.900898e+05 | 0.0 | 98369.0604 | Sell |

| … | … | … | … | … | … | … | … | … | … | … |

| 2016-06-23 | AAPL | 3.951693e+05 | 1.863808e+06 | 0.000000 | 95.582210 | 1900.0 | 5.767755e+05 | 0.0 | 181606.1990 | Buy |

| TWTR | 2.094333e+05 | 1.863808e+06 | 0.000000 | 17.040001 | 10900.0 | 3.951693e+05 | 0.0 | 185736.0109 | Buy | |

| 2016-06-27 | AAPL | 3.833670e+05 | 1.856135e+06 | -4.038123 | 91.544087 | 0.0 | 2.094333e+05 | -0.0 | 173933.7653 | Sell |

| FB | 5.795130e+05 | 1.862921e+06 | 3.770004 | 108.970001 | 0.0 | 3.833670e+05 | 0.0 | 196146.0018 | Sell | |

| 2016-06-28 | SNY | 7.885450e+05 | 1.880959e+06 | 3.110001 | 36.040001 | 0.0 | 5.795130e+05 | 0.0 | 209032.0058 | Sell |

| YHOO | 9.975770e+05 | 1.898997e+06 | 3.110001 | 36.040001 | 0.0 | 7.885450e+05 | 0.0 | 209032.0058 | Sell | |

| 2016-06-30 | AAPL | 8.169157e+05 | 1.898997e+06 | 0.000000 | 95.084904 | 1900.0 | 9.975770e+05 | 0.0 | 180661.3176 | Buy |

| NFLX | 9.907277e+05 | 1.893981e+06 | -2.640000 | 91.480003 | 0.0 | 8.169157e+05 | -0.0 | 173812.0057 | Sell | |

| 2016-07-01 | NFLX | 9.907277e+05 | 1.893981e+06 | 2.549995 | 96.669998 | 0.0 | 9.907277e+05 | 0.0 | 0.0000 | Sell |

| SNY | 8.045767e+05 | 1.893981e+06 | 0.000000 | 37.990002 | 4900.0 | 9.907277e+05 | 0.0 | 186151.0098 | Buy | |

| YHOO | 6.184257e+05 | 1.893981e+06 | 0.000000 | 37.990002 | 4900.0 | 8.045767e+05 | 0.0 | 186151.0098 | Buy | |

| 2016-07-11 | AAPL | 8.016949e+05 | 1.896589e+06 | 1.372569 | 96.457473 | 0.0 | 6.184257e+05 | 0.0 | 183269.1987 | Sell |

| NTDOY | 6.133349e+05 | 1.896589e+06 | 0.000000 | 27.700001 | 6800.0 | 8.016949e+05 | 0.0 | 188360.0068 | Buy | |

| 2016-07-14 | MSFT | 4.264099e+05 | 1.896589e+06 | 0.000000 | 53.407133 | 3500.0 | 6.133349e+05 | 0.0 | 186924.9655 | Buy |

| 2016-07-25 | AAPL | 2.424604e+05 | 1.896589e+06 | 0.000000 | 96.815526 | 1900.0 | 4.264099e+05 | 0.0 | 183949.4994 | Buy |

| FB | 6.001543e+04 | 1.896589e+06 | 0.000000 | 121.629997 | 1500.0 | 2.424604e+05 | 0.0 | 182444.9955 | Buy | |

| 2016-07-26 | GOOG | -8.766857e+04 | 1.896589e+06 | 0.000000 | 738.419983 | 200.0 | 6.001543e+04 | 0.0 | 147683.9966 | Buy |

| 2016-08-18 | NFLX | -2.703726e+05 | 1.896589e+06 | 0.000000 | 96.160004 | 1900.0 | -8.766857e+04 | 0.0 | 182704.0076 | Buy |

| 2016-09-01 | AAPL | -6.758557e+04 | 1.915427e+06 | 9.914477 | 106.730003 | 0.0 | -2.703726e+05 | 0.0 | 202787.0057 | Sell |

| 2016-09-02 | AMZN | 1.641464e+05 | 1.979327e+06 | 213.000000 | 772.440002 | 0.0 | -6.758557e+04 | 0.0 | 231732.0006 | Sell |

| FB | 3.539114e+05 | 1.986647e+06 | 4.880005 | 126.510002 | 0.0 | 1.641464e+05 | 0.0 | 189765.0030 | Sell | |

| GOOG | 5.082034e+05 | 1.993255e+06 | 33.040039 | 771.460022 | 0.0 | 3.539114e+05 | 0.0 | 154292.0044 | Sell | |

| HPQ | 7.081654e+05 | 2.006030e+06 | 0.925746 | 14.490000 | 0.0 | 5.082034e+05 | 0.0 | 199962.0000 | Sell | |

| IBM | 8.996254e+05 | 2.015652e+06 | 8.018727 | 159.550003 | 0.0 | 7.081654e+05 | 0.0 | 191460.0036 | Sell | |

| MSFT | 1.101470e+06 | 2.030572e+06 | 4.262865 | 57.669998 | 0.0 | 8.996254e+05 | 0.0 | 201844.9930 | Sell | |

| NFLX | 1.286492e+06 | 2.032890e+06 | 1.219993 | 97.379997 | 0.0 | 1.101470e+06 | 0.0 | 185021.9943 | Sell | |

| NTDOY | 1.482604e+06 | 2.040642e+06 | 1.139999 | 28.840000 | 0.0 | 1.286492e+06 | 0.0 | 196112.0000 | Sell | |

| SNY | 1.694676e+06 | 2.066563e+06 | 5.289997 | 43.279999 | 0.0 | 1.482604e+06 | 0.0 | 212071.9951 | Sell | |

| TWTR | 1.907771e+06 | 2.093922e+06 | 2.509998 | 19.549999 | 0.0 | 1.694676e+06 | 0.0 | 213094.9891 | Sell | |

| YHOO | 2.119843e+06 | 2.119843e+06 | 5.289997 | 43.279999 | 0.0 | 1.907771e+06 | 0.0 | 212071.9951 | Sell |

475 rows × 9 columns

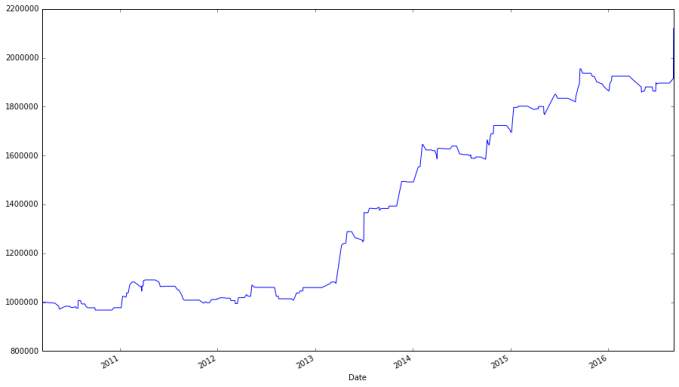

bk["Portfolio Value"].groupby(level = 0).apply(lambda x: x[-1]).plot()

A more realistic portfolio that can invest in any in a list of twelve (tech) stocks has a final growth of about 100%. How good is this? While on the surface not bad, we will see we could have done better.

Benchmarking

Backtesting is only part of evaluating the efficacy of a trading strategy. We would like to benchmark the strategy, or compare it to other available (usually well-known) strategies in order to determine how well we have done.

Whenever you evaluate a trading system, there is one strategy that you should always check, one that beats all but a handful of managed mutual funds and investment managers: buy and hold SPY. The efficient market hypothesis claims that it is all but impossible for anyone to beat the market. Thus, one should always buy an index fund that merely reflects the composition of the market. SPY is an exchange-traded fund (a mutual fund that is traded on the market like a stock) whose value effectively represents the value of the stocks in the S&P 500 stock index. By buying and holding SPY, we are effectively trying to match our returns with the market rather than beat it.

I obtain data on SPY below, and look at the profits for simply buying and holding SPY.

spyder = web.DataReader("SPY", "yahoo", start, end)

spyder.iloc[[0,-1],:]

| Open | High | Low | Close | Volume | Adj Close | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2010-01-04 | 112.370003 | 113.389999 | 111.510002 | 113.330002 | 118944600 | 99.292299 |

| 2016-09-01 | 217.369995 | 217.729996 | 216.029999 | 217.389999 | 93859000 | 217.389999 |

batches = 1000000 // np.ceil(100 * spyder.ix[0,"Adj Close"]) # Maximum number of batches of stocks invested in trade_val = batches * batch * spyder.ix[0,"Adj Close"] # How much money is used to buy SPY final_val = batches * batch * spyder.ix[-1,"Adj Close"] + (1000000 - trade_val) # Final value of the portfolio final_val

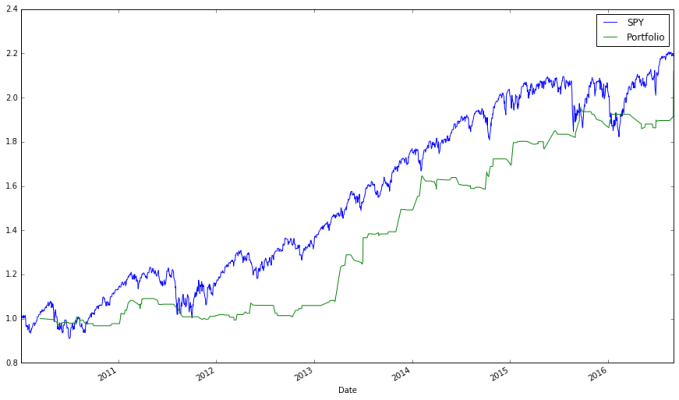

2180977.0

# We see that the buy-and-hold strategy beats the strategy we developed earlier. I would also like to see a plot. ax_bench = (spyder["Adj Close"] / spyder.ix[0, "Adj Close"]).plot(label = "SPY") ax_bench = (bk["Portfolio Value"].groupby(level = 0).apply(lambda x: x[-1]) / 1000000).plot(ax = ax_bench, label = "Portfolio") ax_bench.legend(ax_bench.get_lines(), [l.get_label() for l in ax_bench.get_lines()], loc = 'best') ax_bench

Buying and holding SPY beats our trading system, at least how we currently set it up, and we haven’t even accounted for how expensive our more complex strategy is in terms of fees. Given both the opportunity cost and the expense associated with the active strategy, we should not use it.

What could we do to improve the performance of our system? For starters, we could try diversifying. All the stocks we considered were tech companies, which means that if the tech industry is doing poorly, our portfolio will reflect that. We could try developing a system that can also short stocks or bet bearishly, so we can take advantage of movement in any direction. We could seek means for forecasting how high we expect a stock to move. Whatever we do, though, must beat this benchmark; otherwise there is an opportunity cost associated with our trading system.

Other benchmark strategies exist, and if our trading system beat the “buy and hold SPY” strategy, we may check against them. Some such strategies include:

- Buy SPY when its closing monthly price is aboves its ten-month moving average.

- Buy SPY when its ten-month momentum is positive. (Momentum is the first difference of a moving average process, or

.)

(I first read of these strategies here.) The general lesson still holds: don’t use a complex trading system with lots of active trading when a simple strategy involving an index fund without frequent trading beats it. This is actually a very difficult requirement to meet.

As a final note, suppose that your trading system did manage to beat any baseline strategy thrown at it in backtesting. Does backtesting predict future performance? Not at all. Backtesting has a propensity for overfitting, so just because backtesting predicts high growth doesn’t mean that growth will hold in the future.

Conclusion

While this lecture ends on a depressing note, keep in mind that the efficient market hypothesis has many critics. My own opinion is that as trading becomes more algorithmic, beating the market will become more difficult. That said, it may be possible to beat the market, even though mutual funds seem incapable of doing so (bear in mind, though, that part of the reason mutual funds perform so poorly is because of fees, which is not a concern for index funds).

This lecture is very brief, covering only one type of strategy: strategies based on moving averages. Many other trading signals exist and employed. Additionally, we never discussed in depth shorting stocks, currency trading, or stock options. Stock options, in particular, are a rich subject that offer many different ways to bet on the direction of a stock. You can read more about derivatives (including stock options and other derivatives) in the book Derivatives Analytics with Python: Data Analysis, Models, Simulation, Calibration and Hedging, which is available from the University of Utah library (for University of Utah students).

Another resource (which I used as a reference while writing this lecture) is the O’Reilly book Python for Finance, also available from the University of Utah library.

Remember that it is possible (if not common) to lose money in the stock market. It’s also true, though, that it’s difficult to find returns like those found in stocks, and any investment strategy should take investing in it seriously. This lecture is intended to provide a starting point for evaluating stock trading and investment, and I hope you continue to explore these ideas.

Problems

Problem 1

Devise a trading strategy as described in lecture based on moving-average crossovers (you do not need a stop-loss). Pick a list of at least 15 stocks that have existed since January 1st, 2010. Backtest your strategy with the stocks chosen and benchmark the performance of your portfolio against the performance of SPY. Are you able to beat the market?

Problem 2

Realistically, with every trade a commission is applied. Read about how commission works, and modify the backtest() function in the lecture to allow multiple commission structures (flat fee, percentage of portfolio, etc.) to be simulated.

Additionally, our current moving average crossover strategy results in a trading signal triggering the moment two moving averages cross. We would like to make sure signals are more robust, either by:

- Triggering a trade when the moving averages differ by a fixed amount

- Triggering a trade when the moving averages differ by some amount of (rolling) standard deviations, which are defined by:

(pandas does have means for computing rolling standard deviations.) Regarding the latter, if the moving averages differ by , a trading signal is sent. Modify the function

ma_crossover_orders() so that these restrictions can be implemented. Specifically, you should have the ability to set how many days are in the window of the rolling standard deviation (it need not be the same as either the fast or slow moving average windows), and how many standard deviations the moving averages must differ by in order for a signal to be sent. (The current behavior of these functions should still be possible; in fact, it should be the default behavior.)

Once these changes have been made, repeat problem 1, including a realistic commission scheme (consider looking up one from a brokerage firm) when simulating the performance of the portfolio, and requiring the moving averages differ by some fixed number or standard deviations in order for signals to be sent.

Problem 3

We did not set up our trading system to allow for shorting stocks. Short selling is much trickier, since losses from short selling are unlimited (a long position, on the other hand, limits losses to the total value of the assets purchased). Read about short selling here. Then modify the function backtest() to allow for short selling. How will the function decide how to conduct short sales, including how many shares to short and how to account for shorted stocks when conducting other trades? We leave this up to you to decide. As a hint, the number of shares being shorted can be represented internally in the function by a negative number.

Once this is done, repeat Problem 1, perhaps also using features implemented in Problem 2.

I have created a video course published by Packt Publishing entitled Training Your Systems with Python Statistical Modeling, the third volume in a four-volume set of video courses entitled, Taming Data with Python; Excelling as a Data Analyst. This course discusses how to use Python for machine learning. The course covers classical statistical methods, supervised learning including classification and regression, clustering, dimensionality reduction, and more! The course is peppered with examples demonstrating the techniques and software on real-world data and visuals to explain the concepts presented. Viewers get a hands-on experience using Python for machine learning. If you are starting out using Python for data analysis or know someone who is, please consider buying my course or at least spreading the word about it. You can buy the course directly or purchase a subscription to Mapt and watch it there.

If you like my blog and would like to support it, spread the word (if not get a copy yourself)! Also, stay tuned for future courses I publish with Packt at the Video Courses section of my site.

Thank you for these 2 inspiring lessons about leveraging Finance with Python! The example is available anywhere like github, etc?

Thanks!

LikeLike

The code in these lectures should be usable out of the box (they used to by a Jupyter notebook). You can also find a very close version of these notes at the GitHub repository for the U of U data science course, here: https://github.com/datascience-course/2016-datascience-labs/blob/master/lab6-time-series/lab6-time-series.ipynb

LikeLiked by 1 person

For the following code segment,

# Let’s see the profitability of long trades

apple_long_profits = pd.DataFrame({

“Price”: apple_signals.loc[(apple_signals[“Signal”] == “Buy”) &

apple_signals[“Regime”] == 1, “Price”],

“Profit”: pd.Series(apple_signals[“Price”] – apple_signals[“Price”].shift(1)).loc[

apple_signals.loc[(apple_signals[“Signal”].shift(1) == “Buy”) & (apple_signals[“Regime”].shift(1) == 1)].index

].tolist(),

“End Date”: apple_signals[“Price”].loc[

apple_signals.loc[(apple_signals[“Signal”].shift(1) == “Buy”) & (apple_signals[“Regime”].shift(1) == 1)].index

].index

})

apple_long_profits

I get the following error:

—————————————————————————

ValueError Traceback (most recent call last)

in ()

7 ].tolist(),

8 “End Date”: apple_signals[“Price”].loc[

—-> 9 apple_signals.loc[(apple_signals[“Signal”].shift(1) == “Buy”) & (apple_signals[“Regime”].shift(1) == 1)].index

10 ].index

11 })

/home/vagrant/.local/lib/python2.7/site-packages/pandas/core/frame.pyc in __init__(self, data, index, columns, dtype, copy)

264 dtype=dtype, copy=copy)

265 elif isinstance(data, dict):

–> 266 mgr = self._init_dict(data, index, columns, dtype=dtype)

267 elif isinstance(data, ma.MaskedArray):

268 import numpy.ma.mrecords as mrecords

/home/vagrant/.local/lib/python2.7/site-packages/pandas/core/frame.pyc in _init_dict(self, data, index, columns, dtype)

400 arrays = [data[k] for k in keys]

401

–> 402 return _arrays_to_mgr(arrays, data_names, index, columns, dtype=dtype)

403

404 def _init_ndarray(self, values, index, columns, dtype=None, copy=False):

/home/vagrant/.local/lib/python2.7/site-packages/pandas/core/frame.pyc in _arrays_to_mgr(arrays, arr_names, index, columns, dtype)

5407 # figure out the index, if necessary

5408 if index is None:

-> 5409 index = extract_index(arrays)

5410 else:

5411 index = _ensure_index(index)

/home/vagrant/.local/lib/python2.7/site-packages/pandas/core/frame.pyc in extract_index(data)

5465 msg = (‘array length %d does not match index length %d’ %

5466 (lengths[0], len(index)))

-> 5467 raise ValueError(msg)

5468 else:

5469 index = _default_index(lengths[0])

ValueError: array length 20 does not match index length 21

LikeLike

This tutorial assumes Python 3.

LikeLike

Noted with many thanks

LikeLike

Having the same issue

LikeLike

# Let’s see the profitability of long trades

apple_long_profits = pd.DataFrame({

“Price”: apple_signals.loc[(apple_signals[“Signal”] == “Buy”) &

(apple_signals[“Regime”] == 1) & (apple_signals[“Signal”].shift(-1) == “Sell”), “Price”],

“Profit”: pd.Series(apple_signals[“Price”] – apple_signals[“Price”].shift(1)).loc[

apple_signals.loc[(apple_signals[“Signal”].shift(1) == “Buy”) & (apple_signals[“Regime”].shift(1) == 1)].index

].tolist(),

“End Date”: apple_signals[“Price”].loc[

apple_signals.loc[(apple_signals[“Signal”].shift(1) == “Buy”) & (apple_signals[“Regime”].shift(1) == 1)].index

].index

})

apple_long_profits

LikeLike

This gives me the same general error but this time the array length doesn’t match index length of 0 instead of the previous error that was one higher than my array length.

LikeLike

In this piece of code, do not restore original regime data.

# To ensure that all trades close out, I temporarily change the regime of the last row to 0

regime_orig = apple.ix[-1, “Regime”]

apple.ix[-1, “Regime”] = 0

apple[“Signal”] = np.sign(apple[“Regime”] – apple[“Regime”].shift(1))

# Restore original regime data

apple.ix[-1, “Regime”] = regime_orig

LikeLike

if row[“Low”] < (1 – stoploss) * row["Price"]: # Account for the stop-loss

#the share_profit is stop loss * price.

share_profit = np.round((- stoploss) * row["Price"], 2)

stop_trig = True

else:

share_profit = row["Profit"]

stop_trig = False

LikeLike

I think that your code, is wrong, the share profit, not is stoploss * price. The stoploss is defined as 0.2, then you would have a big loss if calculated the share profit in that way.

That is for the case when row[“Low”] is minor to the 80% or the row[“Price”]

LikeLike

I would also add some slippage into the back test (i.e. the trade is made not i the exact price of the order)

LikeLike

Yes I am also having the same issues as above, the array length does not match index length, any fixes for this? running python 3.5 on rodeo standalone release.

LikeLike

Another way for the apple long profit calculation:

# Let’s see the profitability of long trades

apple_long_profits = pd.DataFrame({

“Price”: apple_signals[“Price”][(apple_signals[“Signal”].shift(1) == “Buy”) & (apple_signals[“Regime”].shift(1) == 1)]

, “End Price”: apple_signals[(apple_signals[“Signal”].shift(1) == “Buy”) & (apple_signals[“Regime”].shift(1) == 1)][“Price”].values

,”End Date”: apple_signals[(apple_signals[“Signal”].shift(1) == “Buy”) & (apple_signals[“Regime”].shift(1) == 1)].index

,”Profit”: (apple_signals[“Price”] – apple_signals[“Price”].shift(1))[(apple_signals[“Signal”].shift(1) == “Buy”) & (apple_signals[“Regime”].shift(1) == 1)].values,

})

apple_long_profits

LikeLike

hello community, my name is Andrea and I’m trying hard to study and learn python applied to financial markets. I apologize in advance if my question is too simple but there’s a piece of code that I don’t really understand what it does. More specifically:

# Let’s see the profitability of long trades

apple_long_profits = pd.DataFrame({

“Price”: apple_signals.loc[(apple_signals[“Signal”] == “Buy”) &

apple_signals[“Regime”] == 1, “Price”],

“Profit”: pd.Series(apple_signals[“Price”] – apple_signals[“Price”].shift(1)).loc[

apple_signals.loc[(apple_signals[“Signal”].shift(1) == “Buy”) & (apple_signals[“Regime”].shift(1) == 1)].index

].tolist(),

“End Date”: apple_signals[“Price”].loc[

apple_signals.loc[(apple_signals[“Signal”].shift(1) == “Buy”) & (apple_signals[“Regime”].shift(1) == 1)].index

].index

})

apple_long_profits

it seems to me we create this new dataframe called apple_long_profits that will filter based on the column “Signal” being equal to “Buy” and at the same time “Regime” being equal to 1. that makes sense.

The “Profit” column gives me a very hard time. We will theoretically show here the different from current Price to the previous one (which one?) and then we filter on rows using .loc but how? I didn’t even know we could use a filter inside .loc[]

and how does .tolist work?

sorry again if it’s too easy but that part completely stopped my learning and understanding of this article. Thanks

LikeLike