Packt Publishing has turned another one of my video courses, Training Your Systems with Python Statistical Modeling, into a book! This book is now available for purchase.

pandas

My Tutorial Book on Anaconda, NumPy and Pandas Is Out: Hands-On Data Analysis with NumPy and Pandas

I announced months ago that one of my video courses, Unpacking NumPy and Pandas, was going to be turned into a book. Today I’m pleased to announce that this book is available!

Unpacking NumPy and Pandas: The Book Is Coming Soon!

I have heard from my publisher, Packt Publishing, that my video course Unpacking NumPy and Pandas will become a book!

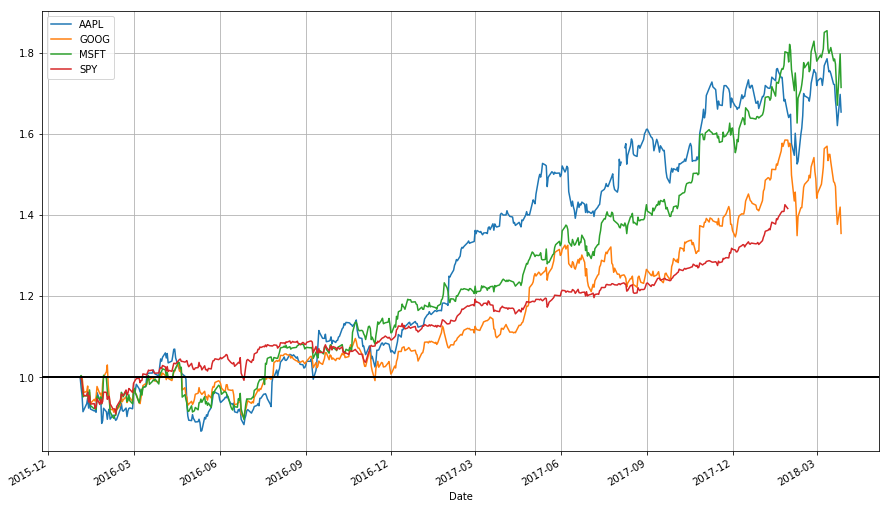

Stock Data Analysis with Python (Second Edition)

Introduction

This is a lecture for MATH 4100/CS 5160: Introduction to Data Science, offered at the University of Utah, introducing time series data analysis applied to finance. This is also an update to my earlier blog posts on the same topic (this one combining them together). I strongly advise referring to this blog post instead of the previous ones (which I am not altering for the sake of preserving a record). The code should work as of July 7th, 2018. (And sorry for some of the formatting; WordPress.com’s free version doesn’t play nice with code or tables.)

Learn Basic Python and scikit-learn Machine Learning Hands-On with My Course: Training Your Systems with Python Statistical Modelling

This post is actually months late, but like with my last video course announcement, it’s better late than never. And besides, of my video courses, I had the most fun writing this one.

Start Getting and Working with Data with “Data Acquisition and Manipulation with Python”

This news is a few weeks late, but better late than never!

Getting S&P 500 Stock Data from Quandl/Google with Python

DISCLAIMER: Any losses incurred based on the content of this post are the responsibility of the trader, not me. I, the author, neither take responsibility for the conduct of others nor offer any guarantees. None of this should be considered as financial advice; the content of this article is only for educational/entertainment purposes.

A few months ago I wrote a blog post about getting stock data from either Quandl or Google using R, and provided a command line R script to automate the task. In this post I repeat the task but with Python. If you’re interested in the motivation and logic of the procedure, I suggest reading the post on the R version. The Python version works similarly.

Get Started Learning Python for Data Science with “Unpacking NumPy and Pandas”

I have exciting news!

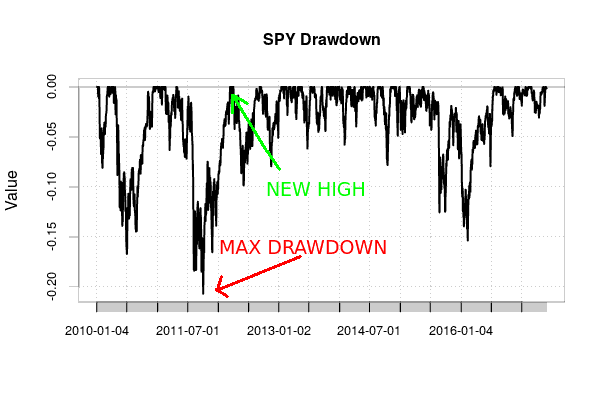

Stock Trading Analytics and Optimization in Python with PyFolio, R’s PerformanceAnalytics, and backtrader

DISCLAIMER: Any losses incurred based on the content of this post are the responsibility of the trader, not me. I, the author, neither take responsibility for the conduct of others nor offer any guarantees. None of this should be considered as financial advice; the content of this article is only for educational/entertainment purposes.

Introduction

Having figured out how to perform walk-forward analysis in Python with backtrader, I want to have a look at evaluating a strategy’s performance. So far, I have cared about only one metric: the final value of the account at the end of a backtest relative. This should not be the only metric considered. Most people care not only about how much money was made but how much risk was taken on. People are risk-averse; one of finance’s leading principles is that higher risk should be compensated by higher returns. Thus many metrics exist that adjust returns for how much risk was taken on. Perhaps when optimizing only with respect to the final return of the strategy we end up choosing highly volatile strategies that lead to huge losses in out-of-sample data. Adjusting for risk may lead to better strategies being chosen.

Walk-Forward Analysis Demonstration with backtrader

DISCLAIMER: Any losses incurred based on the content of this post are the responsibility of the trader, not me. I, the author, neither take responsibility for the conduct of others nor offer any guarantees. None of this should be considered as financial advice; the content of this article is only for educational/entertainment purposes.

Finally I can apply a walk-forward analysis!